Valcreate Investment Approach

Our Investment Approach helps ensure that we only invest in the highest-quality investments for our investors, that have gone through a rigorous fund selection process.

Our investment approach is driven by the following key drivers

GQV Investment Framework

Company selection is driven by Valcreate’s GQV Investment framework, that defines the quantitative & qualitative aspects (focus on business growth, quality & valuations) we consider as part of identifying stocks for investments.

Clearly Defined Investment Process

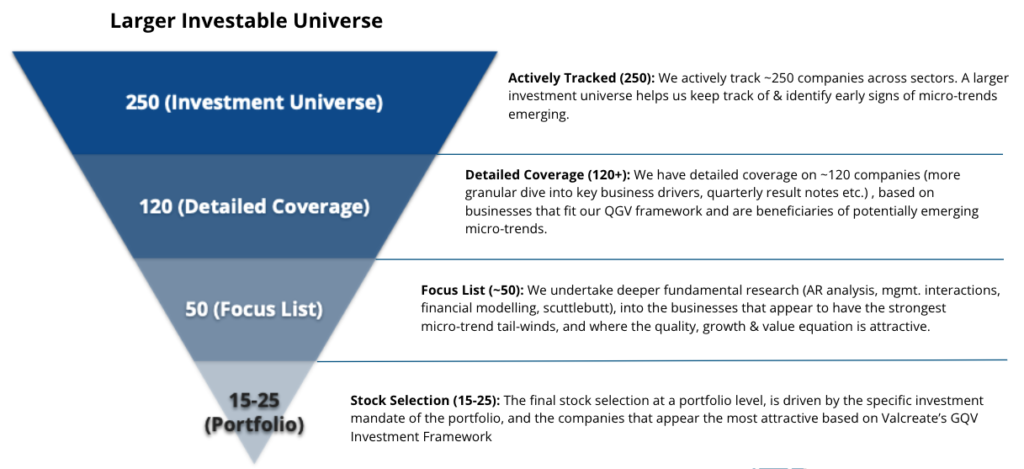

A rigorous & clearly-defined process that includes moving from the larger investment universe to stock selection, due-diligence processes & portfolio construction frameworks.

Proprietary Research Tools

IME Insights (a proprietary research tool developed by Ashi Anand), helps document our key research insights along with quantiative data in one central research-database. This tool helps ensure deep discipline & rigor in our research documentation & proesses.

GQV Investment Framework

G for Growth

We believe that growth is the primary driver of business value creation, and we accordingly seek to invest in companies with sustainable medium-to-long-term growth potential.

The focus is on the medium-term growth outlook, where we can identify specific economic/sectoral/business trends that support growth outperformance to the markets/economy.

Our focus is on future growth potential & the sustainability of the same – not on just how a company has grown in the past.

The aim is to invest in companies with the potential to drive capital-efficient growth, and not in companies that require large debt or equity raises to drive growth.

Q for Quality

We seek to invest in high-quality businesses, driven by their competitive moats, management quality, governance and financial strength.

Competitive Moats: that allow a business to earn super-normal returns over the longer-term. This can include Intangibles (brands, IP, Technology), Network effects, Distribution or Cost Advantages

Management Quality & Governance: quality of the board, accounting practices, capital allocation, management pedigree, treatment of minority shareholders, promoter shareholding

Financials: ROE/ROCE, cash flows, BS strength, operating margins

V for Valuations

Our focus is on buying high-quality businesses, with clear growth potential that are available at the right price.

We recognize that business value is intrinsically linked to quality & growth. We accordingly are willing to pay higher multiples for better-quality & higher-growth businesses.

We will avoid paying astronomical valuations, where we believe that quality & growth are being overpriced.

We will also avoid value-traps – business with weak growth prospects, lower quality businesses or companies with poor management/governance track records.

Clearly Defined Investment Processes

A clearly-defined investment process, helps ensure that our research-processes are driven by institutional best-practices of fund management.

- Stock shortlisting: driven by Valcreate’s GQV Framework, underlying market conditions & the specific requirements of Individual Portfolios. Stock’s can be recommended for investments to the Investment Committee, by either of the CIO’s or Research Analysts.

- Independence in fund management by both CIO’s: Rajesh & Ashi maintain complete independence in fund management decisions for the respective investment strategies that they manage.

- New Stocks go through Investment Committee prior to Portfolio Inclusion: Any new stock to be included in a portfolio, is first discussed in a formal Investment Committee headed by the 2 CIO’s and the research analysts. The team member proposing the stock idea, presents the investment case and answers all queries raised by other team members.

- Monthly Red Team Reviews: On a monthly basis, all core investment calls across portfolios are subject to a Red Team Review, where a specific devil’s advocate view is debated against each of the investment calls to understand the specific risks associated with a specific investment call not playing out.

- Quarterly Reviews: A more detailed review of all investments and companies in the pipeline, are undertaken at the end of each results seasons, based on the results announced & management interactions taken place. This detailed quarterly review, is over and above constant monitoring of the portfolio & positions on a regular basis.

Proprietary Research Tools

Our Proprietary Research Tools helps ensure the rigour & discipline of our investment process.

All investment insights documented in IME Insights (proprietary Research Management Solution), a cloud-based technology solution that documents all investment views, result updates, fundamental scores, price targets & more based on rigorous fundamental research.

IME Insights is one of the most sophisticated research management solutions in the investments industry, and helps institutionalize best-in-class research processes & disciplines for our investment team.

Since all data (quantitative & qualitative insights) are stored in a structured database, smart querying of the database allows for comparison of qualitative insights & data across companies & sectors, providing valuable insights that help drive our decision making.

Instant access to key insights is a key driver of our ability to spot emerging micro-trends and identify the best sectors, sub-sectors & companies to invest in.

IME Insights is a tool developed by Ashi Anand, and is available on a subscription basis (with institutional fund managers being a key target market). Peer review of our insights, ensures that our team has to consistently maintain a very high level of discipline & rigour in our investment processes.