India is experiencing a seismic shift as we embrace the digital era, redefining how a billion-plus population lives, works, and connects. Through a series of blog posts, we will dive deep into this journey and the implications of the same in various sectors. We also look into how new-age digital companies are strong beneficiaries.

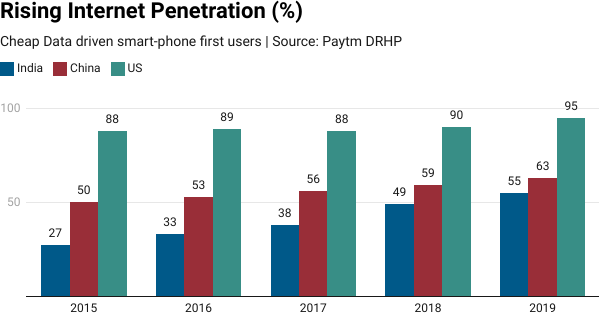

India witnessed an unprecedented surge in digital connectivity over the past decade. The proliferation of smartphones and affordable mobile data has bridged geographical gaps, bringing even the country’s remotest corners into the digital fold. This newfound connectivity catalyzes inclusive growth, enabling individuals from all walks of life to participate in the digital landscape.

At the heart of India’s connectivity surge lies the proliferation of smartphones. The last decade has witnessed a remarkable increase in smartphone penetration, driven by declining device costs, affordable data plans, and the availability of budget-friendly models. The smartphone, once a luxury, has become a necessity, connecting individuals across the sub-continent.

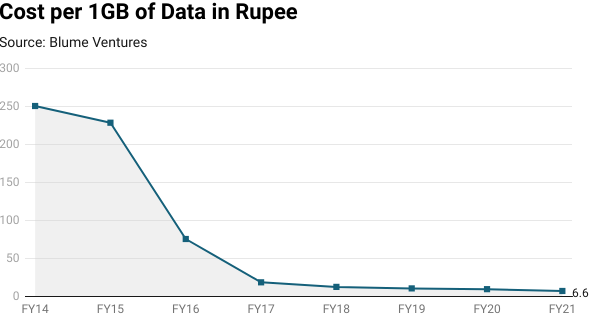

Another factor that led to the tremendous penetration of smartphone use is low-cost data. Thanks to Jio, fierce competition has driven down data costs, making it accessible to a broader segment of the population. This affordability has opened up a world of possibilities, enabling users to engage in online activities, from communication and education to entertainment and commerce.

India Stack

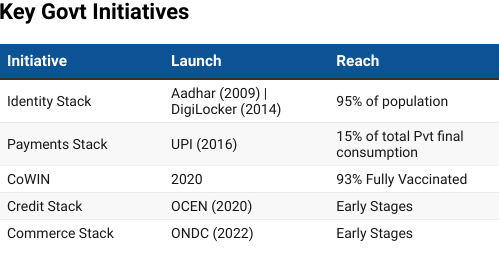

The catalyst for India’s digital revolution lies in India Stack, a set of APIs and digital infrastructure that is reshaping the way people interact with government services, businesses operate, and financial transactions occur.

Aadhaar, the brainchild of Mr. Nandan Nilekeni, provides a digital identity to every Indian citizen, making it the largest biometric ID system in the world. This foundational layer enables seamless and secure authentication, laying the groundwork for various digital services and direct transfer benefits.

The eKYC leverages Aadhaar for paperless and presence-less identity verification. This has reduced the friction across business activity especially within the financial sector, through paperless and effortless customer onboarding, enhancing the speed and efficiency of service.

Digital Locker, another layer of the India Stack, allows citizens to securely store and share their documents digitally. This not only reduces the need for physical documents but also ensures that individuals have easy and controlled access to their essential records.

These are just 2 layers of the India Stack that is making everyday life seamless.

Governance in India is undergoing a digital makeover. The government’s emphasis on e-governance initiatives is streamlining administrative processes, reducing bureaucratic hurdles, and fostering transparency. From digital identity through Aadhaar to online service delivery, citizens are experiencing the benefits of a government committed to leveraging technology for efficiency and inclusivity.

Other Key Government Initiatives

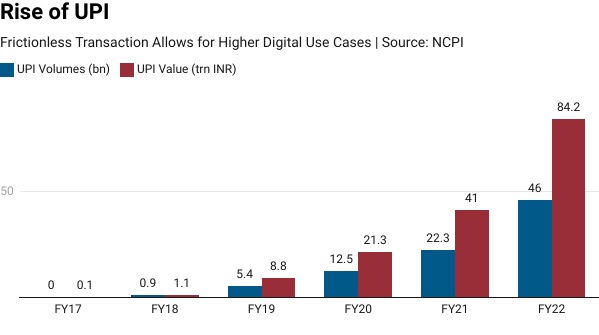

Fintech – the Astronomical Rise of UPI

Over the past decade, the UPI has emerged as a game-changer, transforming the way individuals and businesses conduct financial transactions, and playing a pivotal role in fostering financial inclusion.

UPI has been a key driver of financial inclusion in India. It provides a digital payments platform reaching the most remote areas of India and empowering individuals who may not have access to traditional banking infrastructure. The simplicity has made digital transactions more inclusive, bridging the gap between the banked and unbanked. The digital revolution is dismantling traditional barriers to financial access.

As UPI continues to evolve, it stands as a testament to the transformative power of digital technology in the financial domain.

Such an unconventional yet powerful journey of digital adoption has impacted several industries. Digital adoption is changing consumer behaviour and accordingly, we believe, will determine wealth creation through the process of creative destruction. In the upcoming blog, we discuss the impact of Covid-19 in further accelerating digital adoption in India.