IME Digital Disruption PMS

India's only fund to Invest Exclusively in Listed Digital Platforms

Why you need Digital Platforms in your Portfolio

- Substantially Higher Growth

- Very Strong Core LT Profitability Evident

- Very Strong Business Moats

- Consumers are Becoming Digitally Native

- Tremendous Wealth Creation Globally

But is Investing in Loss-making Companies Sensible?

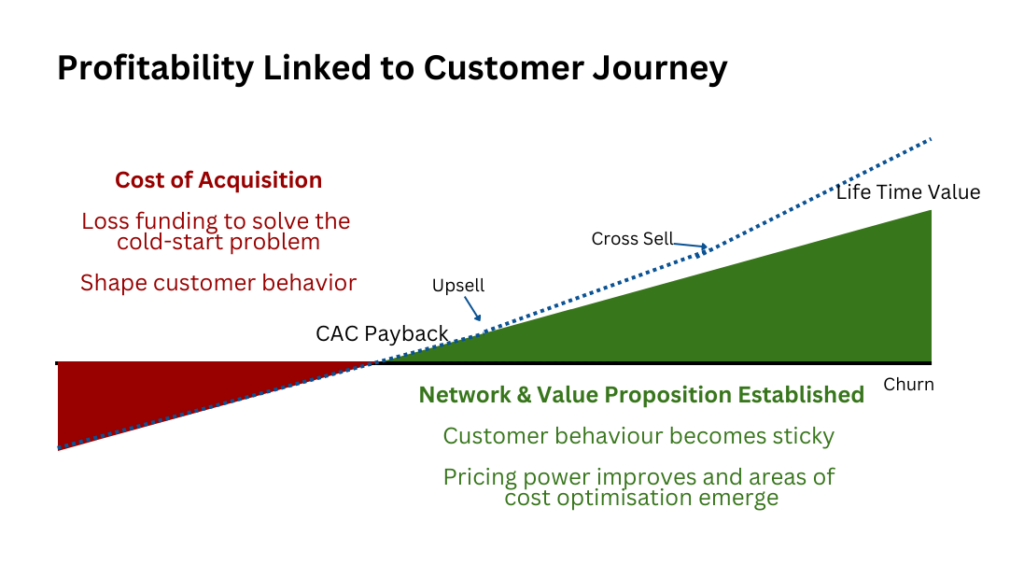

Listed market investors misunderstand new-age digital platform business models.

Building the network requires large upfront investments. These investments help drive super-normal growth & very strong competitive moats.

Once the networks stabilise, these upfront investments can be pulled down sharply & monetisation can increase substantially.

Value-creation Potential of this Model seen Globally

The large upfront investments leads to sustainable super-normal profitability & very high-value creation over the longer term.

This has been seen clearly in US Tech’s disproportionate value creation in the past decade. Very strong signs of the same happening in India going forward.

Trends for Indian Value Creation are Clear

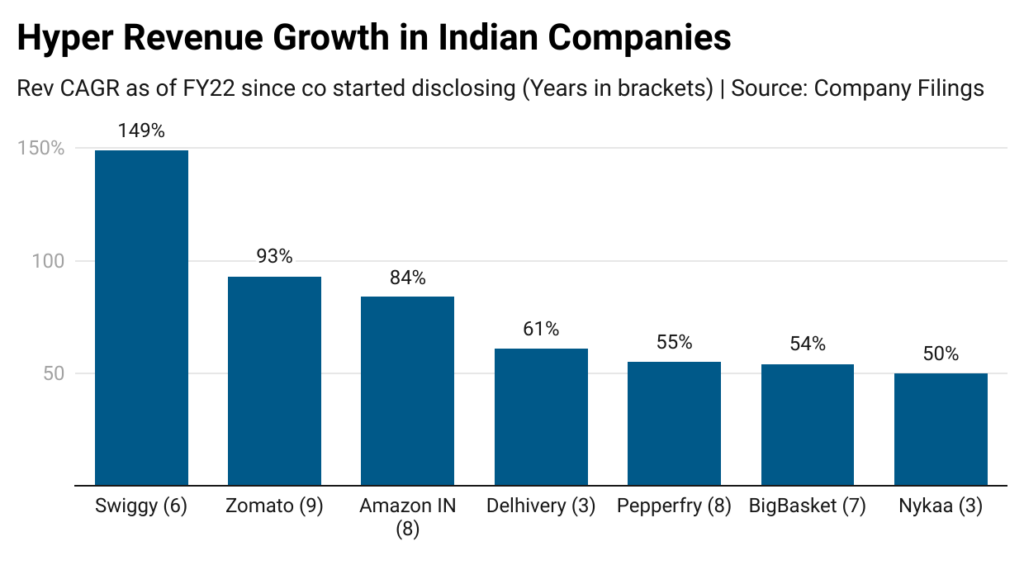

Growth is Evident

Very strong enablers in place for digital adoption to continue to rise

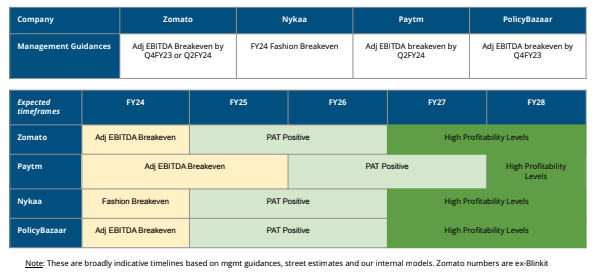

Clear Path to profitability

Areas for margin improvements and path to profitability are clearly identifiable

Value Creation to Follow

We see Indian Digital Firms outperforming over the coming decade, similar to what was seen in the US over the last decade

Path to Profitability is Evident

About IME Digital Disruption Strategy

- Concentrated portfolio investing exclusively in listed digitally-native platform businesses

- Tightly defined stock selection & portfolio construction methodologies

- Private-equity approach to listed market investing

- Offered by Valcreate PMS - with 2 senior Fund Managers with close to 5 decades of experience in top AMCs in India

- Fund managed by Ashi Anand - over 2 decades of fund management experience, with sustained outperformance