Valcreate Life Sciences and Speciality Opportunities PMS

Dedicated Pharma and Speciality Chemicals Strategy

Pharma sector is a significant long-term value creator

- Large macro growth potential: significant proportion of branded medicines globally going generic

- India opportunity: global leader in supplying low-cost & high quality medicines. Large pool of low-cost talent.

- Defensive nature: Business model is relatively insulated from economic cycles.

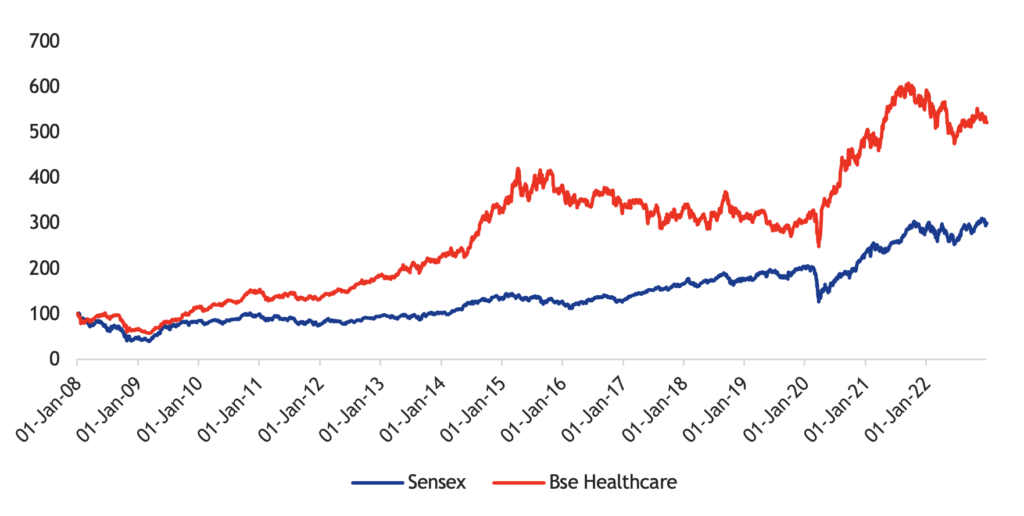

Strong Long-term Value Creation

Over FY08-FY22, INR 1cr invested in the BSE

Healthcare Index would be worth Rs.

5.2 cr vs. 3 cr for a similar investment in the Sensex.

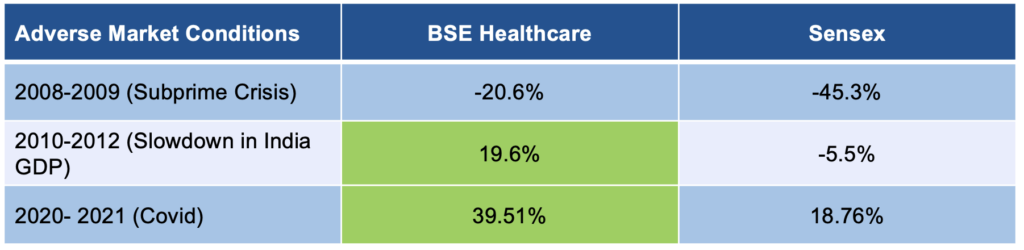

Acts as a strong defensive play in weak markets

- Non-Discretionary Spends: patient’s healthcare spends are not dependent on the economy/sentiment

- Beneficiary of Rupee Depreciation: economic downturns are typically linked with a weak rupee

- Strong Balance Sheets: Strong free cash generation, balance sheets and margins

Chemicals

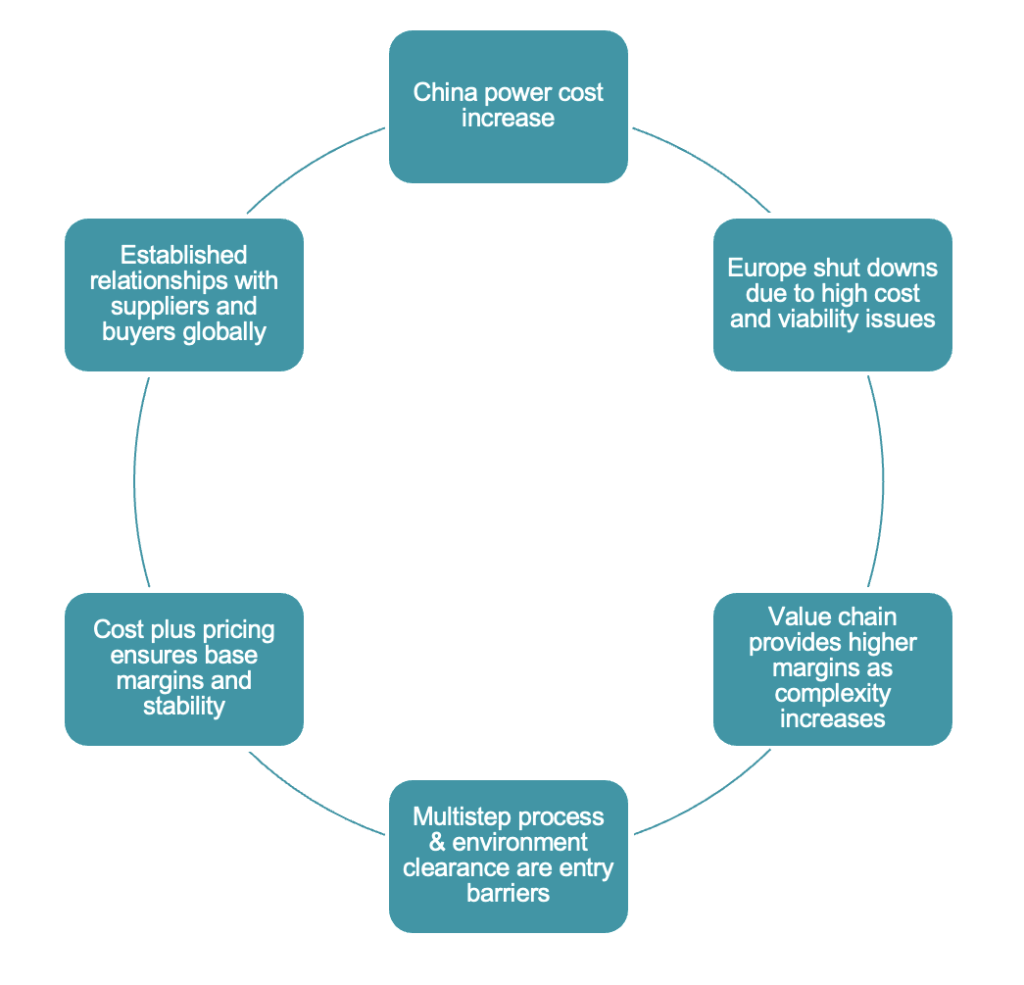

Speciality Chemicals - Focusing on Value Chains

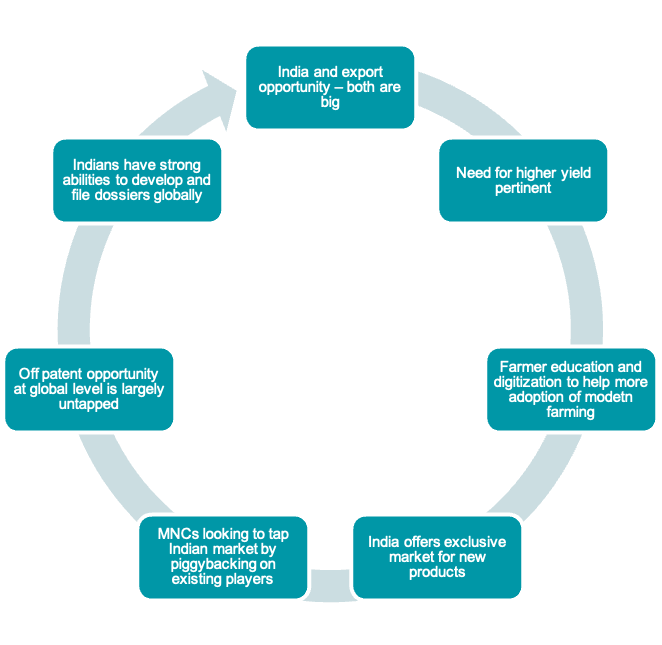

Agrochemicals is a 2 faced Opportunity

Economy Agnostic

Aligned to pharma and agrochemicals industry which are more economy agnostic.

Key characteristics that make multibaggers in pharma

- Promoters: Technocrat Promoters, Corporate Governance and Capabilities

- Product Portfolio: Factors such as Generics, Speciality, Low Competition, Complex products dictate Sustainable Profitability

- Target Markets: Large Innovators, Generics, Tender Markets, Branded Markets, Branded Generics being Catered to

- Market Share: High Share in Leading Products

- Pipeline: Large Filing Pipeline, Pending Approvals, Launch Opportunity and R&D Focus

Our Track Record Speaks for Itself

- Life Sciences and Speciality Opportunities Strategy has given 18% CAGR vs 14% of Benchmark between inception to mid-2021

- Within just 2 years of existence, Valcreate Strategies delivered Leading Performance

- For most months in 2020, Life Sciences Strategy was the number 1 Performing Strategy, especially during Market Crash (as per PMS Bazaar)

- Many of the Picks are Multi-baggers in the Portfolio

- Avoiding Big Mistake is the Pillar