IME Concentrated Microtrends PMS

Large & Mid cap Fund that Invests in Value-Creating Microtrends

Understanding Microtrends

- Microtrends are pockets of the economy with greater value-creation potential

- Microtrends are different from sectoral or thematic funds with their much granular focus on sub-trends within specific themes

- Value creation by microtrends is dynamic and often differs based on unique economic and market conditions

Micro-trends are not sectoral or thematic in nature - they are specific sub-parts of a sector, theme or the economy where we see the greatest potential for value-creation within the larger investment universe.

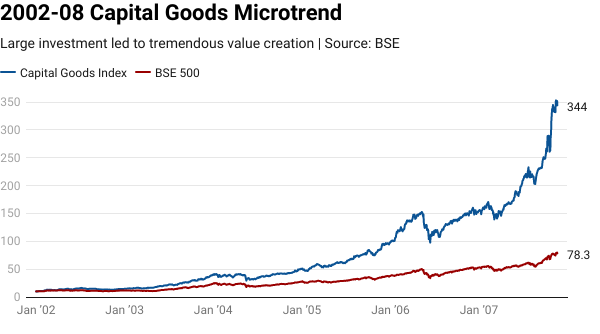

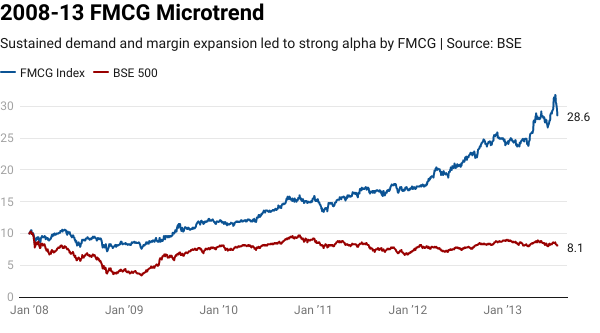

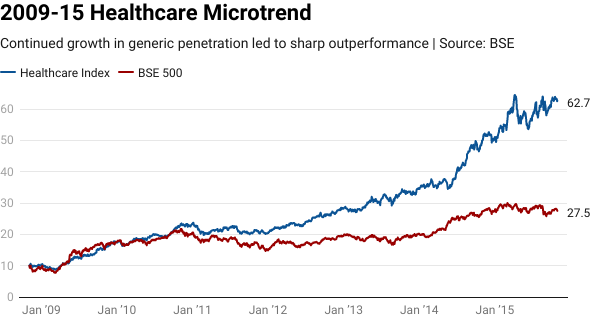

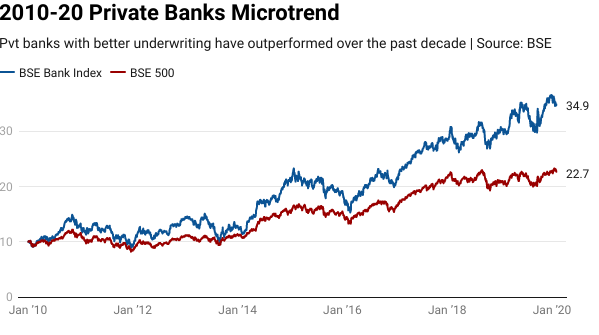

Microtrends Case Studies

Every market cycle has certain underlying trends that drive the greatest value creation, which we call microtrends.

About IME Concentrated Microtrends Strategy

- We follow a concentrated investment approach to specific microtrends by investing in high-quality large & mid cap beneficiaries

- We believe by taking concentrated exposures to identified microtrends can lead to substantial outperformance

- Our strategy takes a balanced approach to 3 key factors - Quality, Growth and Valuations

- Our portfolio is constructed across 4-8 microtrends with 20-30 holdings.

- This leads to superior risk-adjusted returns without having to resort to inherent risks of investing in small-caps or lower-quality companies

Microtrends We Are Currently Invested In

Within Economic Mega-trends, the Strategy seeks to have Concentrated Exposure to Specific Sub-trends with the

Greatest Growth & Value-creation Visibility.

Asset Quality Normalisation

We expect the discount of leading corporate & secured retail banks to narrow versus retail bank leaders, as corporate asset quality normalises and retail becomes the new potential area of stress.

Lending Franchises

Expect leading lending franchises to continue to compound investor returns, driven by the large growth runway driven by value migration from PSU banks to private lenders.

Digital Disruption

Digital platforms are amongst the highest growing companies, with their current high losses being due to hyper-growth investments. As these companies turn profitable in coming years, substantial value creation is expected to play out.

Capex Revival

Starting with China +1 and India’s timely response with tax cuts and PLI incentives – a confluence of factors are driving the rise of manufacturing and green energy transition in India. This is expected to lead to a capex recovery.

Consumer Aspirational

Rising consumption demand is a clear multi-year theme on the back of strong demographic trends, rising incomes & aspirations and changing consumer preferences. With Indian GDP per capita having recently crossed the $2000 mark, a substantial rise in discretionary consumer spends is expected to take place over the coming decade.

Chemicals, API, CRAMs

Chemicals, API and CRAMS are a key beneficiary of China +1. Indian companies have strong cost & quality competencies in this area, and are expected to be key beneficiaries of this shift. China lockdowns have pushed global companies to accelerate their plans on ensuring diversification & risk-mitigation of their supply chains diversify their supply chain for good.

IT Services

Enterprise spends on modernisation of tech stacks, migration to cloud and data integration is a multi-year multi-project opportunity for India IT companies. Across industries, enterprise IT spending is moving up for transformation deals and managing the digital presence, which was fuelled by Covid. India’s labour cost arbitrage plays a crucial advantage to deliver on the digital transformation.

Residential Real Estate Recovery

Our investment thesis for the Residential Real Estate Micro-trend, is driven by a combination of strong improvements in affordability and a large expected shift from unorganised to organised players (due to RERA, GST, financing availability issues, COVID, buyer preference for quality brands). We see the potential for the Real Estate industry to turnaround after a lost decade.