Economic landscapes are rarely static. Adapting to varying economic conditions is a hallmark of seasoned investors. The most successful investments are strategically positioned to navigate through different economic cycles. This doesn’t allow investors to survive; it allows them to thrive by aligning their portfolios with the prevailing economic tides.

In the dynamic world of finance, every decade unfurls a new tapestry of market trends, offering investors fresh opportunities and challenges.

At Valcreate Investment Managers, we strongly believe in this. In this blog post, we outline our “Microtrends” approach and a few examples from the Indian market to support our thesis.

Micro-trends are not sectoral or thematic – they are specific sub-parts of a sector, theme or economy, with differing value-creation dynamics from that of the larger sector, theme or economy in which it is operating. Additionally, microtrends can sometimes refer to an underlying trend that can span companies across multiple sectors. Microtrends are dynamic and often differ based on unique economic and market conditions.

To understand micro-trends better, we can take the example of Financial Services in India. Structural Reforms and the Strong Demographic dividends of India are macro-trends that are aiding growth for financial services. The BFSI Sector in India can be broken up into the Banking, NBFC, Capital Market & Insurance Industries. Microtrends within financial services include Asset Quality Normalisation for Corporate Banks, Value Migration towards Financial Franchises, or the Financialisation of Savings.

In our “IME Concentrated Microtrends” investment strategy, we follow a concentrated investment approach to specific microtrends with the greatest potential for value creation. We believe that taking concentrated exposures to identified microtrends can lead to substantial outperformance, within established large & mid-cap companies, helping deliver a superior risk-adjusted return.

Our portfolio is constructed across 4-8 microtrends with 20-30 holdings. We have observed that when we align our portfolios to strong value-creating microtrends, our portfolio leads to superior risk-adjusted returns without having to resort to the inherent risks of investing in small-caps or lower-quality companies.

Case Studies from the Past

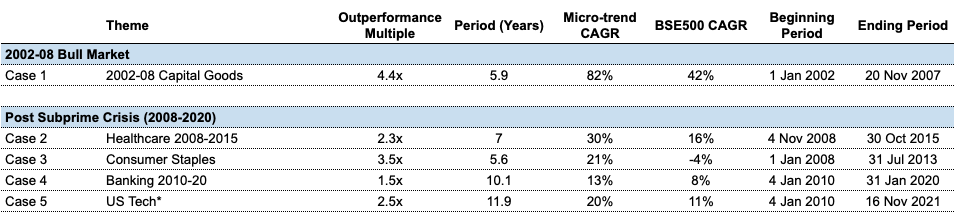

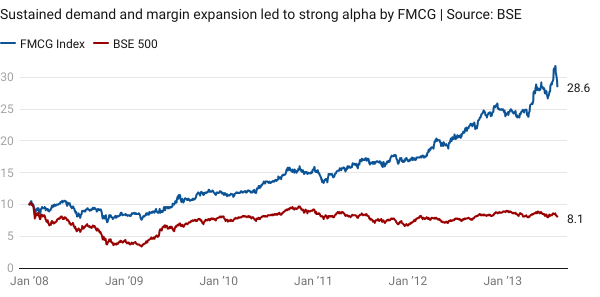

Over the past 2 decades, we have seen multiple microtrends generating wealth as seen above. We take a closer look at a few of these microtrends:

2002-08 Capital Goods Bull Run

The 2002-08 bull market has been the strongest bull market in India over the past couple of decades. While virtually all investments delivered returns over this period, the large capital formation that took place over this period led to a substantial outperformance of capital good companies.

This microtrend generated 82% CAGR over this period outperforming the index substantially.

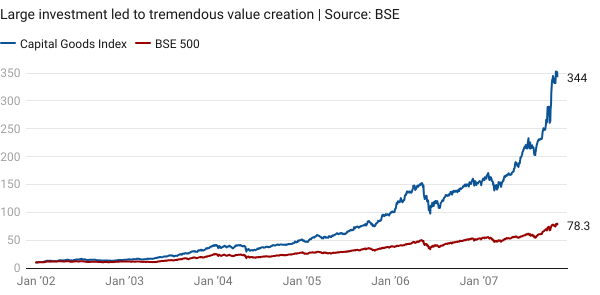

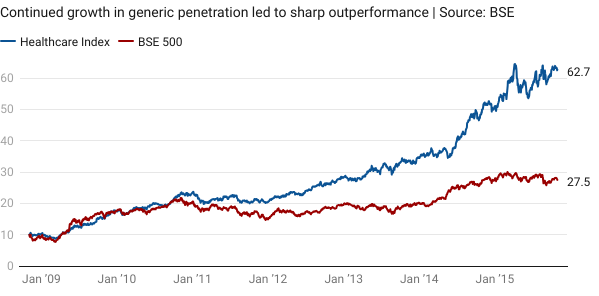

Post Subprime Crisis: 2008-2013 FMCG and 2008-15 Healthcare

Even as markets recovered from their 2008 lows post the subprime crisis, the 2008-15 period was a period where economic growth was relatively muted. Low physical investment activity during this period, accompanied by general growth weakness across sectors & businesses, led to a sharp underperformance of economic cyclicals.

The bulk of the value-creation over this period, took place in defensive sectors such as Healthcare (boosted by key large drug approvals of Indian pharma firms) & FMCG (boosted by margin expansions driven by low raw-material prices).

These microtrends generated 30% and 21% CAGR respectively over this period outperforming the index substantially.

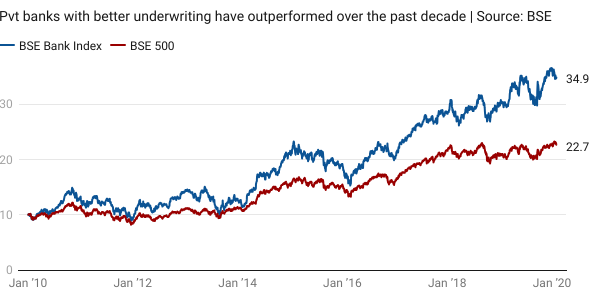

2010-20 Private Banking Franchises

Driven by value migration from PSU Banks, private sector banks have seen sustained outperformance over the past decade. This outperformance was particularly strong in leading retail-focused private sector banks (whose outperformance was stronger & more consistent than PSU & corporate-focused private sector banks, which pulled down the performance of the BSE Bank Index).

Investing is a journey through time, and each decade introduces a new set of challenges and opportunities. By understanding historical trends and staying attuned to the pulse of the current market, investors can position themselves to ride the waves of change and navigate the complexities of the financial seas. As we embrace the future, the ability to adapt and embrace innovative trends will be paramount for those seeking to build and preserve wealth in the ever-evolving world of finance.